|

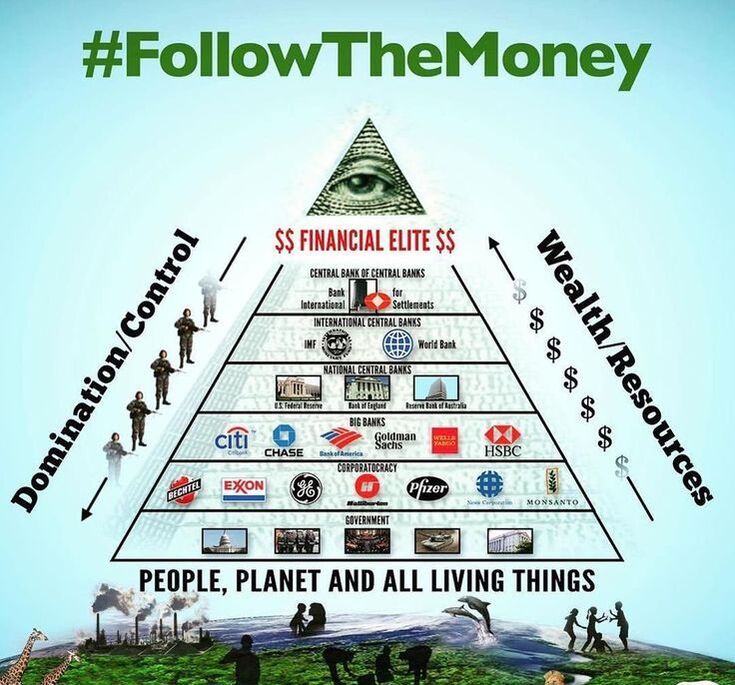

In the public consciousness, there's a pervasive misapprehension that the game revolves solely around money. Traditionally, money has indeed served as a proxy for power, but the reality is far more complex—the true game is about power and control.

Contrary to popular belief, money doesn't function in the straightforward manner we assume. While it has historically represented a means of exchange and a storage of wealth, its true value is subject to manipulation and control. At its core, the ability to store wealth in money is contingent upon policy and the faith we place in its value. However, when those in power resort to printing money to address crises, they effectively undermine the value of existing currency, robbing individuals of their stored wealth without ever directly accessing their bank accounts. This manipulation places the value of our stored wealth under the control of external forces, leaving us vulnerable to the whims of those who understand and control the game. Money operates on two distinct levels:

However, the powers that be are acutely aware that dollars and other forms of currency will likely retain their traditional meanings for the foreseeable future, allowing them to enact strategies for safeguarding their wealth, even in the face of global crises. In essence, we're being set up—a grand illusion is being perpetuated, wherein the true game of power and control operates behind the facade of money. To truly understand and navigate this game, we must recognize that the rules are constantly shifting, and the value we ascribe to money is more fragile and contingent than we realize. As we continue to grapple with the complexities of the modern financial landscape, it becomes increasingly important to question the narratives we've been fed and to strive for a deeper understanding of the forces at play behind the scenes. Only then can we hope to reclaim agency and autonomy within the game of power and control that shapes our world.

In our exploration of the intricate game of power and control behind money, it's essential to delve deeper into the strategies employed by the powers that be to safeguard their wealth, even amidst global crises.

One notable tactic often employed is the adage of "never let a good crisis go to waste." This mantra underscores the opportunistic nature of those in positions of power, who capitalize on moments of turmoil to further their agendas and consolidate control. The problem-reaction-solution paradigm is another tool wielded by those in power. By manipulating public perception and exploiting crises, they can steer the narrative and implement solutions that serve their interests while ostensibly addressing the issues at hand.

A telling example of this dynamic is illustrated by Alan Greenspan, the former chairman of the Federal Reserve. In a revealing interview, Greenspan candidly admits the power of the Federal Reserve to "print more money," underscoring the autonomy and influence wielded by central banks.

Furthermore, Greenspan's assertion of the Federal Reserve's independence highlights a crucial aspect of the power structure—an independence that effectively shields central banks from external oversight or interference, allowing them to operate with impunity.

The Federal Reserve, often referred to as the Fed, is commonly misunderstood as a government entity. However, it's crucial to recognize that the Federal Reserve is, in fact, an independent agency. This distinction is essential because it means that the Federal Reserve operates autonomously from direct government control.

Established in 1913 by the Federal Reserve Act, the Fed functions as the central bank of the United States. It was created with the intention of providing a stable monetary and financial system for the country. One of the primary purposes of its independence is to insulate monetary policy decisions from political influence, allowing the Fed to focus on long-term economic stability rather than short-term political considerations. This independence is enshrined in law and is supposedly designed to ensure that the Fed can make decisions based on economic principles and data rather than political pressure. It allows the Fed to carry out its dual mandate of promoting maximum employment and stable prices without undue interference. Understanding the independent nature of the Federal Reserve is crucial for comprehending its role in the economy and the significance of its actions, including setting interest rates, regulating banks, and managing the money supply. United Nations: agenda 2030

The 2030 Agenda, encompassing the UN Sustainable Development Goals, ostensibly aims to "end poverty in all its forms everywhere." While this goal is undoubtedly noble, scrutiny reveals the underlying mechanisms—such as central bank digital currencies—that serve as vehicles for accruing power and control under the guise of humanitarian efforts.

Ultimately, it's crucial to recognize that the elites driving these agendas are driven by self-interest and the preservation of their power. They operate without moral constraints, prioritizing control and dominance over the welfare of the populace.

In navigating the complex landscape of global finance and governance, it's imperative to remain vigilant, questioning the motives and actions of those who wield power, and advocating for transparency and accountability in all aspects of governance and finance.

History has documented this agenda of globalist powers and the pivotal role played by private central banks perpetuating conflicts and oppression worldwide. Meticulous research and critical analysis has veiled mechanisms behind historical events and emphasizes the severe consequences of unchecked power.

Delving into the historical context of private central banks, a repeated pattern of wars throughout history have been instigated and financed by powerful banking interests to further their own agendas. From the American Revolutionary War to the establishment of the Federal Reserve, a pattern of manipulation and exploitation emerges, with banking elites profiting from conflicts at the expense of entire populations. Key historical events, such as the World Wars and political assassinations, have been scrutinized to reveal the underlying motives and consequences of these conflicts. The recurring theme of deception and manipulation orchestrated by private central banks is documented, underscoring the need to question mainstream narratives and take action to reclaim sovereignty and freedom. It's time to confront uncomfortable truths and challenge the status quo. By exposing the dark underbelly of globalist agendas and the complicity of private central banks in perpetuating oppression, it is in the world's best interest to resist tyranny and strive for a world of sovereign human beings. The Great Taking

"The Great Taking," as articulated by David Rogers Webb, unveils a grand design orchestrated by a select few—a scheme of unfathomable magnitude aimed at the systematic confiscation of all assets, marking the culmination of a globally synchronized debt accumulation super cycle.

This meticulously planned endeavor encompasses the appropriation of collateral on an unprecedented scale, transcending boundaries of financial assets, bank deposits, stocks, bonds, and the underlying property of corporations and individuals alike. No facet of wealth, whether public or private, remains immune from the grasp of this audacious conquest. At its core lies the consolidation of control over all central banks, exerting dominion over the levers of money creation and, by extension, the political, corporate, and media landscapes. The orchestration of a hybrid war against humanity, waged by shadowy figures hidden from public view, underscores the magnitude of the threat posed by this clandestine agenda. David Rogers Webb's insights, drawn from a wealth of experience navigating the intricacies of financial markets and governance, offer a sobering perspective on the forces at play. With a keen understanding of historical precedents and evolutionary imperatives, Webb shines a light on the enduring quest for control and power—a timeless pursuit that transcends epochs and civilizations. As we confront the realities of a world shaped by hidden agendas and opaque power structures, Webb's warnings serve as a clarion call to vigilance and discernment. In an era defined by uncertainty and upheaval, it falls upon us to challenge the narratives of control and domination, and to safeguard the principles of transparency, accountability, and human dignity. references

United Nations. “The 17 Sustainable Development Goals.” United Nations, 2024, sdgs.un.org/goals.

0 Comments

In THE SHOCK DOCTRINE, Naomi Klein explodes the myth that the global free market triumphed democratically. Exposing the thinking, the money trail and the puppet strings behind the world-changing crises and wars of the last four decades, The Shock Doctrine is the gripping story of how America’s “free market” policies have come to dominate the world-- through the exploitation of disaster-shocked people and countries.

At the most chaotic juncture in Iraq’s civil war, a new law is unveiled that would allow Shell and BP to claim the country’s vast oil reserves…. Immediately following September 11, the Bush Administration quietly out-sources the running of the “War on Terror” to Halliburton and Blackwater…. After a tsunami wipes out the coasts of Southeast Asia, the pristine beaches are auctioned off to tourist resorts.... New Orleans’s residents, scattered from Hurricane Katrina, discover that their public housing, hospitals and schools will never be reopened…. These events are examples of “the shock doctrine”: using the public’s disorientation following massive collective shocks – wars, terrorist attacks, or natural disasters -- to achieve control by imposing economic shock therapy. Sometimes, when the first two shocks don’t succeed in wiping out resistance, a third shock is employed: the electrode in the prison cell or the Taser gun on the streets. Based on breakthrough historical research and four years of on-the-ground reporting in disaster zones, The Shock Doctrine vividly shows how disaster capitalism – the rapid-fire corporate reengineering of societies still reeling from shock – did not begin with September 11, 2001. The book traces its origins back fifty years, to the University of Chicago under Milton Friedman, which produced many of the leading neo-conservative and neo-liberal thinkers whose influence is still profound in Washington today. New, surprising connections are drawn between economic policy, “shock and awe” warfare and covert CIA-funded experiments in electroshock and sensory deprivation in the 1950s, research that helped write the torture manuals used today in Guantanamo Bay. The Shock Doctrine follows the application of these ideas through our contemporary history, showing in riveting detail how well-known events of the recent past have been deliberate, active theatres for the shock doctrine, among them: Pinochet’s coup in Chile in 1973, the Falklands War in 1982, the Tiananmen Square Massacre in 1989, the collapse of the Soviet Union in 1991, the Asian Financial crisis in 1997 and Hurricane Mitch in 1998. This film is based on the New York Times and International #1 bestseller, Winner of the 2009 Warwick Prize for Writing and translated into over 30 languages. The Shock Doctrine was originally published in September 2007. Naomi Klein’s third book, The Shock Doctrine is the unofficial story of how the “free market” came to dominate the world. But it is a story radically different from the one usually told. It is a story about violence and shock perpetrated on people, on countries, on economies. Based on breakthrough historical research and four years of on-the-ground reporting in disaster zones, Klein explodes the myth that the global free market triumphed democratically, and that unfettered capitalism goes hand-in-hand with democracy. Instead, she argues it has consistently relied on violence and shock, and reveals the puppet strings behind the critical events of the last four decades. The six minute companion film, created by Oscar Award winning director Alfonso Cuarón, was an Official Selection of the 2007 Venice Biennale and Toronto International Film Festivals. An investigation that spans four decades of history, from Chile after Pinochet’s coup to Russia after the collapse of the Soviet Union, from Baghdad under the US “Shock and Awe” attack to New Orleans after Hurricane Katrina. “Shock doctrine” describes the brute tactic of systematically using the public’s disorientation following a collective shock—wars, coups, terrorist attacks, market crashes, natural disasters—to push through radical pro-corporate measures, often called “shock therapy.” Based on breakthrough historical research and four years of on-the-ground reporting in disaster zones, Klein explodes the myth that the global free market triumphed democratically, and that unfettered capitalism goes hand-in-hand with democracy. Instead, she argues it has consistently relied on violence and shock, and reveals the puppet strings behind the critical events of the last four decades. The Shock Doctrine retells the story of the most dominant ideology of our time, how the “free market” came to dominate the world — Milton Friedman’s free market economic revolution. In contrast to the popular myth of this movement’s peaceful global victory, Klein shows how it has exploited moments of shock and extreme violence in order to implement its economic policies in many parts of the world from Latin America and Eastern Europe to South Africa, Russia, and Iraq. A program of social and economic engineering that is driving our world, that Naomi Klein calls “disaster capitalism”. Klein vividly traces the origins of modern shock tactics back to the economic lab of the University of Chicago under Milton Friedman in the 60s, and beyond to the CIA-funded electroshock experiments at McGill University in the 50s which helped write the torture manuals used today at Guantanamo Bay. At the core of disaster capitalism is the use of cataclysmic events to advance radical privatization combined with the privatization of the disaster response itself. By capitalizing on crises, created by nature or war, Klein argues that the disaster capitalism complex now exists as a booming new economy, and is the violent culmination of a radical economic project that has been incubating for fifty years. Thrilling and revelatory, The Shock Doctrine cracks open the secret history of our era. As John Gray wrote in The Guardian, “There are very few books that really help us understand the present. The Shock Doctrine is one of those books.” Vandana Shiva is an Indian scholar, environmental activist, physicist, food sovereignty advocate, and anti-globalization author. Based in Delhi, Shiva has written more than 20 books. Shiva founded the Research Foundation for Science, Technology, and Natural Resource Policy (RFSTN), an organization devoted to developing sustainable methods of agriculture, in 1982. She has traveled the world spreading a powerful message of oneness and interconnectedness.

Widespread poverty, social unrest, and economic polarization have become our lived reality as the top 1% of the world’s seven-billion-plus population pushes the planet―and all its people―to the social and ecological brink. Vandana Shiva takes on the billionaire dictators of Gates, Buffet, and Mark Zuckerberg, as well as other modern empires like Big Tech, Big Pharma, and Big Ag, whose blindness to the rights of people, and to the destructive impact of their construct of linear progress, have wrought havoc across the world. Their single-minded pursuit of profit has undemocratically enforced uniformity and monocultures, division and separation, monopolies and external control―over finance, food, energy, information, healthcare, and even relationships. Basing her analysis on explosive facts, Shiva exposes the 1%’s model of philanthrocapitalism, which is about deploying unaccountable money to bypass democratic structures, derail diversity, and impose totalitarian ideas based on One Science, One Agriculture, and One History. Instead, Shiva calls for the resurgence of:

With these core goals, people can reclaim their right to: Live Free. Think Free. Breathe Free. Eat Free. Many people have their own theory about the way the world should work, but few combine it with action. Today on The Corbett Report we explore the writings of Samuel Konkin, and how his central idea, agorism, combines the theory and practice of freedom through counter-economic action. Agora! Anarchy! Action!

|

This feed contains research, news, information, observations, and ideas at the level of the world.

Archives

May 2024

Categories

All

|

RSS Feed

RSS Feed